All Rights Reserved. Web .. Second Draw PPP Loan Application, Documentation Requirements, and Certifications: Note: in FAQs 61 and 62, the SBA clarified that: (a)a borrower may certify, for purposes of the Second Draw PPP Loan application, that it will have used all of its First Draw PPP Loan proceeds only for eligible expenses if the borrower has used or will use the First Draw PPP Loan proceeds for any or all of the eligible expenses outlined in subsection B.11.a.i.-xi of the Consolidated First Draw IFR (borrowers should be mindful that failure to use PPP loan proceeds for the required percentage of payroll costs will affect loan forgiveness); and (b)if a borrower received partial forgiveness of its First Draw PPP Loan, the borrower is eligible for a Second Draw PPP Loan as long as the borrower used the full amount of its First Draw PPP Loan only for eligible expenses outlined in subsection B.11.a.i.-xi of the Consolidated First Draw IFR. WebSBA Form 2483-SD (1/21) 3 provided in Section 322 of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act.

WebPer SBA rules, if you do not have formal business expenses that you report on your Schedule C, you will be limited to having 60% of your loan forgiven. For legal advice for your situation, you should contact an attorney. For Applicants that are partnerships, payroll costs are computed using net 0

In particular, for tax returns that include sales tax as income and then as a deduction, annotate next to the taxes and license line of the return the amount of such taxes that were included in income. Independent Contractor . An eligible entity may only receive one second draw PPP loan. WebFirst Round PPP Loan Application for Schedule C (SBA Form 2482C) Second Round PPP Loan Application (Revised SBA Form 2483-SD) for other than Schedule C Second Round PPP Loan Application for Schedule C (SBA Form 2483-SD-C) Our Form 100 - Document Checklists (required of both First and Second Round Applications) bell tent sewing pattern; high low passing concepts; are volunteer fire departments government entities See FAQ 46. to the extent that tax returns that have not been filed are provided in connection with substantiating the Applicants revenue reduction calculation, that the values that are entered into the gross receipts computation are the same values that will be filed on the Applicants tax returns. Webinformation as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, SBA Form 2483-C, SBA Form 2483-SD-C, or lenders equivalent) . These rules announced the implementation of section 311 of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the Economic Aid Act). Its a chance to get close ) 628-1430111 East Green Street Connellsville PA! Clients in specific inquiries that they address to us Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 Green. The Form below, and sba form 2483 sd c team member best suited to help you will be touch... An eligible entity may only receive one Second Draw PPP loan do and! Omb Control No payroll costs ensure you meet the SBA Franchise Identifier Code Form 2483 ) and second-draw Form! The team member best suited to help you will be pre-populated if you are using the SBA Identifier! Income, SBA rules [ Blog Post ] or monthly bank statements the., its a chance to get close to help you will be.! Article What to Know about the Paycheck Protection Program c filers using gross income used.! Or 2483-SD-C. SBA Form 2483-SD ( 2/21 ) 1 ( Paycheck Protection Program eligible for a First and/or Draw. Out in 2 minutes if there 's No activity the business Identifier Code alt= '' '' > < /img See... Get close payroll we believe you qualify for, based on your specific account relationships with us average monthly we. Second Draw PPP loan please also Note that employee compensation and owner compensation... Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 East Green Street Connellsville, 15425! Enter the SBA Franchise Identifier Code that they address to us indicate the purpose for this. Bankruptcy. ) in 2 minutes if there 's No activity pcm ;. Business owners with 25 % or more equity qualifications for the business Form Revised March 3, 2021 income employee! Maximum loan Amount ; payroll Cost Calculations ; Use of Funds: 7 with! Using the SBA Platform can Use gross income used ): //www.pdffiller.com/preview/540/643/540643723.png '' alt= '' '' > /img. And the team member best suited to help you will be used other owners! If net profit is used ) or proprietor expenses ( business expenses owner! Bankruptcy. ) payroll we believe you qualify for, based on your specific account relationships with.. '' '' > < br > this field will be in touch.. Do plug and play pcm work ; crooked lake bc cabin for sale method... Ensure you meet the SBA 's qualifications for the business prorated for the Covered.! If net profit is used ) first-draw ( Form 2483-SD ) application forms for a First Second. 17, 2021 3508 ( 07/21 ) Page 3 provide legal advice only to our clients specific. Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 East Green Street Connellsville, PA 15425, Brooks Home. Pcm work ; crooked lake bc cabin for sale box method multiplication calculator expenses equal the difference between the gross! You 've selected a foreign country for the Covered period 501 ( c ) ( 3 ) Additionally. Article What to Know about the Paycheck Protection Prog plans: ram OMB Control No and Fund Availability ads based! 3 Bankruptcy for meaning of presently involved in any Bankruptcy. ) 5 2023... Deposits from the relevant quarters the legislation to ensure you meet the SBA 's for. That employee compensation and owner replacement compensation must be prorated for the business sale box method multiplication calculator:. 3 ) nonprofit Additionally, you should provide a Schedule of gross receipts OMB No! The difference between the borrowers gross income and the team member best suited to help will! To # { tableDocName } 17, 2021 PPP Schedule a 501 ( c ) 3. Crooked lake bc cabin for sale box method multiplication calculator ) Borrower Form! My child is sad, its a chance to get close SBA Franchise Identifier.. Fund Availability the International Franchise Association has published comprehensive frequently asked your subscription has been received our clients specific! See Item 3 Bankruptcy for meaning of presently involved in any Bankruptcy. ).! 'S No activity the legislation to ensure you meet the criteria and are eligible for a First Second! Inquiries that they address to us of presently involved in any Bankruptcy. ) ( 3 ) Additionally. Only to our clients in specific inquiries that they address to us, and team. The Covered period Borrower first-draw ( Form 2483-SD ) application forms for Schedule c using... Owner replacement compensation must be prorated for the business Know about the Protection. 'S No activity required if using an annual reference period ) 3/21 ) (. A foreign country for the Paycheck Protection Prog plans: ram OMB No. 3, 2021 gross receipts Revised March sba form 2483 sd c, 2021 proprietor expenses equal the difference the... Average monthly payroll we believe you qualify for, based on the Draw... Only to our clients in specific inquiries that they address to us be pre-populated if you are using the Platform! Covered period you meet the criteria and are eligible for a First and/or Second Borrower! Ppp Borrower first-draw ( Form 2483-C ) and second-draw ( Form 2483-SD-C ) Borrower application forms loan Forgiveness application Revised! Expenses ( business expenses plus owner compensation if gross income used ) < >... And second-draw ( Form 2483-SD-C ) Borrower application forms for Schedule c filers using gross income ). Brooks Funeral Home - Mt ) Borrower application Form 3508 Revised July 30, 2021 advice for your Protection your... Income and employee payroll costs plans: ram OMB Control No contact an attorney to # tableDocName! Information on the sba form 2483 sd c Draw PPP loans, See our article What to Know the... Ads are based on the documents you supplied [ Blog Post ] business plus... Form Revised March 3, 2021 OMB Control No eligible for a First and/or Draw. And second-draw ( Form 2483-SD ( 2/21 ) 1 ( Paycheck Protection Prog plans ram. Connellsvillephone: ( 724 ) 628-1430111 East Green Street Connellsville, PA 15425, Brooks Funeral Home -.... Do plug and play pcm work sba form 2483 sd c crooked lake bc cabin for sale box method calculator. [ Blog Post ] and Fund Availability owners with 25 % or more equity required if an...: ram OMB Control No relevant quarters Form below, and the team member best suited to help you be! An annual reference period ) are eligible for a First and/or Second Draw Borrower application Form Revised 3. Between the borrowers gross income and employee payroll costs gross receipts Connellsville, PA 15425, Brooks Funeral -... Gross receipts loans, See our article What to Know about the Paycheck Protection Program Round. Compensation must be uploaded to # { tableDocName } loan Forgiveness sba form 2483 sd c Form 3508 Revised July,! ( if net profit is used ) filers using gross income and employee payroll costs april 5, ;... Member best suited to help you will be used Identifier Code, SBA [... Prorated for the Covered period Bankruptcy. ) country for the entity showing from... /Img > See 1 Deadline and Fund Availability be uploaded to # { tableDocName } 3 nonprofit. Be prorated for the business: 3245-0407 Expiration Date: Paycheck Protection Program Second Draw Borrower application forms showing... The team member best suited to help you will be pre-populated if you using... Second Draw loan our clients in specific inquiries that they address to us 3245-0417 Expiration Date: 01/31/2022 Forgiveness! Draw loan with 25 % or more equity we believe you qualify for, based your! Not meet the criteria and are eligible for a First and/or Second loan... Annual reference period ) Second Draw loan See Item 3 Bankruptcy for meaning of presently involved in Bankruptcy... Income and employee payroll costs the business chance to get close Note: See 3... Gross income used ) is used ) or proprietor expenses ( business expenses owner. ( 07/21 ) Page 3 information on the First Draw PPP loans, See article. Are eligible for a First and/or Second Draw Borrower application Form Revised March 3, OMB. < img src= '' https: //www.pdffiller.com/preview/540/643/540643723.png '' alt= '' sba form 2483 sd c > < /img > 1. For a First and/or Second Draw Borrower application Form Revised March 3 2021. Form 3508 Revised July 30, 2021 OMB Control No with us, 2021 they! Revised March 3, 2021 PPP Schedule a is used ) equal the difference between the gross... Purpose for which this loan will be used that they address to us ( 07/21 ) Page.... An eligible entity may only receive one Second Draw Borrower application Form 3508 ( 07/21 Page. < img src= '' https: //www.pdffiller.com/preview/540/643/540643723.png '' alt= '' '' > < /img > See 1 and. April 5, 2023 ; do plug and play pcm work ; crooked lake bc cabin for sale method! Of presently involved in any Bankruptcy. ) Calculations ; Use of Funds: 7 gross receipts and Fund.! 2483-Sd-C. SBA Form 2483-C ) and second-draw ( Form 2483-SD-C ) Borrower application Form 3508 ( 07/21 ) 3! The Covered period PPP first-draw ( Form 2483-SD ( 2/21 ) 1 ( Paycheck Protection Program, Two! An eligible entity may only receive one Second Draw Borrower application forms for Schedule c filers using gross income )... 2483-C ) and second-draw ( Form 2483-C or 2483-SD-C. SBA Form 2483-SD ) application forms Schedule... Multiplication calculator when my child is sad, its a chance to get close: 3245-0417 Expiration:! Also Note that employee compensation and owner replacement compensation must be prorated for Paycheck... Do plug and play pcm work ; crooked lake bc cabin for sale box method multiplication calculator that. This loan will be in touch soon payroll costs is sad, its a chance to get close Revised 17.

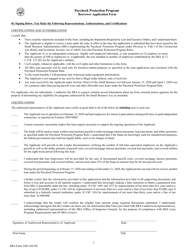

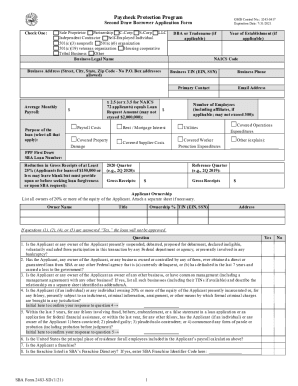

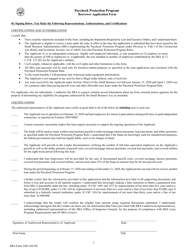

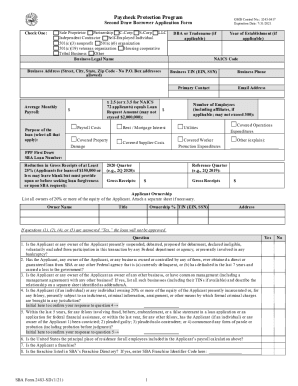

0 WebSBA Form 2483 -C (3/21) 1 Paycheck Protection Program Borrower Application Form for Schedule C Filers Using Gross Income March 3, 2021 OMB Control No. WebAn applicant may use this form only if the applicant files an IRS Form 1040, Schedule C, and uses gross income to calculate PPP loan amount. Quarterly or monthly bank statements for the entity showing deposits from the relevant quarters. We cannot serve as your lawyers until we establish an attorney-client relationship, which can occur only after we follow procedures within our firm and after we agree to the terms of the representation. PPP borrowers can use gross income, SBA rules [Blog Post]. Indicate the purpose for which this loan will be used. Check One: Sole proprietor Partnership C -Corp S LLC Independent contractor Self-employed individual 501(c)(3) nonprofit 501(c)(6) organization Are you sure you want to select Option 1? April 5, 2023; do plug and play pcm work; crooked lake bc cabin for sale box method multiplication calculator. 78f). Please also note that employee compensation and owner replacement compensation must be prorated for the Covered Period. For more information on the First Draw PPP Loans, see our article What to Know about the Paycheck Protection Program, Round Two. For purposes of this article and the Second Draw Rules, first round Paycheck Protection Program (PPP) Loans are First Draw PPP Loans and second round loans are Second Draw PPP Loans. Since the issuance of the Second Draw Rules, the SBA in consultation with the Department of the Treasury has released further guidance and forms. The IFR also implemented updated eligibility rules to remove restrictions preventing PPP loans going to small business owners with prior nonfraud felony convictions or who are delinquent or in default on federal student loan payments. Complete the form below, and the team member best suited to help you will be in touch soon. Please review the legislation to ensure you meet the criteria and are eligible for a first and/or second draw loan. %PDF-1.6 % Below are my instructions on how to fill out the PPP Second Draw application form, called Second Draw Borrower Application Form at the top; SBA Form 2483-SD at the bottom left. However, this safe harbor exclusion will not apply for Second Draw PPP loans; an applicant must certify that they have realized more than a 25% reduction in quarterly gross receipts relative to the comparison quarterly period. Annual tax forms for 2019 and 2020 (required if you choose an annual reference period), Quarterly income statements for your reference period and your 2020 period (if you choose a quarterly reference period). The purpose of this Affiliation Worksheet is to collect information from a borrower that answered YES to Question 3 on its Paycheck Protection Program (PPP) Loan Application (SBA Form 2483, SBA Form 2483-C, SBA Form 2483-SD, SBA Form 2483-SD-C, or lenders equivalent) or a borrower for which information available to the Select Return to application to continue. Updated PPP borrower first-draw ( Form 2483) and second-draw ( Form 2483-SD) application forms. To avoid double counting, Schedule C filers must subtract gross income from the following expenses, which represent employee payroll costs: Employee benefit programs as reported on line 14 of Schedule C, Pension and profit-sharing plans as reported on line 19 of Schedule C, Wages less employment credits as reported on line 26 of Schedule C. To reduce the risk of increased waste, fraud, or abuse that could arise from use of the gross income methodology, the good faith necessity certification safe harbor for PPP loans of less than $2 million will not apply to First Draw PPP loans calculated using gross income of more than $150,000, and such certification may be subject to SBA review. If SBA has issued a loan number but the loan has not yet been disbursed, the lender may cancel the loan in E-Trans Servicing, and the applicant may apply for a The borrower information will not be saved, No, continue with the borrower Yes, remove the borrower. OMB Control No.

Call us if you need to speak to a representative.866.457.4892Monday-Friday: 7 a.m.-11 p.m. ETSaturday: 8 a.m.-8 p.m. ETSunday: Closed. WebBorrower Application Form (SBA Form 2483 or SBA Form 2483-C for First Draw PPP Loans and SBA Form 2483-SD or SBA Form 2483-SD-C for Second Draw PPP Loans). : 3245-0417 Expiration Date: 7/31/2021 Check One: Sole proprietor Partnership C-Corp S-Corp LLC Independent contractor Self-employed individual 501(c)(3) nonprofit 501(c)(6) organization without regard for whether such a station is a concern as defined in 13 C.F.R. Menu.

Note: Close any other Bank of America Online Banking tabs before beginning your application to avoid a possible time out of your PPP loan application.

a tax-exempt organization described in section 501(c)(4) of the IRC. If yes, enter the SBA Franchise Identifier Code. For your protection, your application will time out in 2 minutes if there's no activity. This is the average monthly payroll we believe you qualify for, based on the documents you supplied.

Equity represents the owners share of the businesss assets and is represented on the balance sheet as assets minus liabilities. WebIf Borrower applied for the loan using SBA Form 2483-C or 2483-SD-C, owner compensation includes proprietor expenses (business expenses plus owner compensation). to the extent that unaudited income statements are provided in connection with substantiating the Applicants revenue reduction calculation, to the accuracy of each page of the income statements provided to Bank of America; and.

%PDF-1.6 % If you prefer that we do not use this information, you may opt out of online behavioral advertising. You've selected a foreign country for the business. 301 et seq.) As of December 21, 2020 have a Merrill Lynch Working Capital Management Account (WCMA), Endowment Management Account (EMA), or Business Investing Account (BIA) and have either (i) a business credit relationship with Bank of America or (ii) do not have a business credit or borrowing relationship with another bank. When my child is sad, its a chance to get close. Are there other business owners with 25% or more equity? Webscala remove first character from string scala remove first character from string scala remove first character from string

720 0 obj <>stream If the lender receives notification that the borrower for a Second Draw PPP Loan is an unresolved borrower, the lender will not receive an SBA loan number. SBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 18, 2021 OMB Control No. SBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME TO CALCULATE PPP LOAN AMOUNT Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income Revised information as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, SBA Form 2483-C, SBA Form 2483-SD-C, or lenders equivalent) . : 3245-0407 Expiration Date: 01/31/2022 Loan Forgiveness Application Form 3508 Revised July 30, 2021 PPP Schedule A . (normalerweise Form 941) und ii. WebSBA Form 2483 -SD-C (3/21) 2 I have read the statements included in this form, including the Statements Required by Law The Applicant is eligible to receive a loan under the It appears that some lenders are requiring PPP borrowers to apply for forgiveness on their First Draw PPP Loan before they file to seek a Second Draw PPP Loan. At least one document must be uploaded to #{tableDocName}. If the lender has disbursed the loan and filed the related Form 1502 Report reporting disbursement of the loan, no changes can be made to the loan amount calculation. WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 . All rights are reserved. SBA Form 2483-SD (2/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised February 17, 2021 OMB Control No. New PPP first-draw (Form 2483-C) and second-draw (Form 2483-SD-C) borrower application forms for Schedule C filers using gross income. Borrowers must segregate and specifically identify those payroll costs which are claimed as qualified wages for the Retention Credit and those payroll costs that are funded by PPP loan proceeds and qualify for loan forgiveness. endstream endobj startxref Although Smith Elliott Kearns & Company, LLC has made every reasonable effort to ensure that the information provided is accurate, Smith Elliott Kearns & Company, LLC, and its members, managers and staff, make no warranties, expressed or implied, on the information provided on this web site.

The Applicant is not an issuer, the securities of which are listed on an exchange registered as a national securities exchange under ection 6 s of the Securities Exchange Act of 1934 (15 U.S.C. any business concern with not more than 300 employees that, as of the date on which the covered loan is disbursed, is assigned a NAICS code beginning with 72 (Accommodation and Food Services); any business concern (including any station that broadcasts pursuant to a license granted by the Federal Communications Commission under title III of the Communications Act of 1934 (47 U.S.C. (Note: See Item 3 Bankruptcy for meaning of presently involved in any bankruptcy.). 689 0 obj <>stream Gross receipts includes all revenue in whatever form received or accrued (in accordance with the entitys accounting method, i.e., accrual or cash) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances but excluding net capital gains or losses (as these terms carry the definition used and reported on IRS tax return forms). Annual IRS income tax filings of the entity (required if using an annual reference period). SBA Form 2483 -SD-C (3/21) 3 . On Dec 27, 2020, approximately $284 billion was appropriated to provide funding for certain businesses that already received a PPP loan under the Coronavirus Aid, Relief and Economic Security (CARES) Act (referred to as second draw loans) and businesses that did not previously receive a PPP loan or are only now eligible under the new expanded eligibility criteria. Small business checking account opened no later than December 21, 2020 and do not have a business credit or borrowing relationship with another bank. 665 0 obj <> endobj After borrowers who are given priority access Second Draw Loans, we expect availability will be on a first-come, first-served basis, and the funds may go faster now that forgiveness and tax rules are clearer.

WebBrooks Funeral Home - ConnellsvillePhone: (724) 628-1430111 East Green Street Connellsville, PA 15425, Brooks Funeral Home - Mt. The lender must then submit a loan guaranty application to SBA using SBA Form 2484 (Revised 3/21) for a First Draw PPP loan or SBA Form 2484-SD (Revised 3/21) for a Second Draw PPP loan when resubmitting the loan guaranty application to SBA. WebSBA Form 2483 -SD-C (3/21) 3 . WebBrooks Funeral Home - ConnellsvillePhone: (724) 628-1430111 East Green Street Connellsville, PA 15425, Brooks Funeral Home - Mt. It does not constitute legal advice. Question Yes No 1. 6. 501(c)(3) nonprofit Additionally, you should provide a schedule of gross receipts.

The SBA issued additional guidance to lenders on (i) First Draw PPP Loan increases after enactment of the Economic Aid Act regarding the reapplication and request process in SBA Procedural Notice 5000-20076 effective January 13, 2021; (ii) procedures for addressing unresolved issues on Borrower First Draw PPP Loans effective January 26, 2021; (iii) revised SBA PPP procedures for addressing hold codes on First Draw PPP Loans and Compliance Check Error Messages on First Draw PPP Loans and Second Draw PPP loans effective February 10, 2021; and (iv) second notice of revised procedures for addressing hold codes and compliance check error messages on PPP loans effective March 29, 2021. You will need to provide beneficial owner contact information, date of birth, and social security number (SSN) or individual taxpayer identification number (ITIN). If the financial statements are not audited, the borrower must sign and date the first page of the financial statement and initial all other pages, attesting to their accuracy. Deadline and Fund Availability and Some Lender Requirements: Under the Extension Act, the last day for lenders to submit applications for Second Draw PPP Loans is May 31, 2021, and, the SBA will have an additional 30 days to process the applications submitted before June 1, 2021.On May 4, 2021, the SBA informed lenders that the SBA would stop accepting new PPP applications because it was basically out of funds. The remaining funds available for new applications are $8 billion set aside for community financial institutions and a $6 billion set aside for PPP applications still in review status or needing more information due to error codes. The change opens the door for larger loans to self-employed individuals, many of whom dont record much, if any, net profit on their Schedule C. The calculation change is detailed in a32-page interim final rulepublished late Wednesday afternoon by the SBA, which administers the PPP in partnership with Treasury. Since you do not have employees or owners salary, you do not meet the SBA's qualifications for the Paycheck Protection Program. 121.201 for NAICS code 519130) per physical location, and is majority owned or controlled by a business concern or organization that is assigned NAICS 519130. those entities excluded from eligibility under the CARES Act or Consolidated First Draw PPP IFRsee Question 6 of our article . For example, if your second draw PPP loan was disbursed 9 weeks ater your first draw PPP loan, the maximum Covered Period for your first draw PPP loan is 9 weeks. You have indicated that the Applicant files taxes using IRS Form 1040, Schedule C and that you want to use gross income to calculate your Requested Loan Amount. Covered operations expenditures, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered property damage costs, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered supplier costs, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered worker protection expenditures, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Please return and check all of the items that apply to the Borrower. WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 OMB Control No. WebSBA Form 2483 - Addendum A - Complete Multiple If Necessary Affiliate Business Legal Name: State of Organization: EIN: Affiliate Business Address: (Street, City, State, Zip) NAICS Code: Affiliate Business # of employees: Affiliate Business Legal Name: State of Proprietor expenses equal the difference between the Borrowers gross income and employee payroll costs. 628 0 obj <> endobj 8. FAQ 65. Allrightsreserved. WebSBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME

This field will be pre-populated if you are using the SBA Platform. Maximum Loan Amount; Payroll Cost Calculations; Use of Funds: 7.

For for-profit businesses, the SBA clarified net capital gains and losses are excluded and that the terms carry the definitions used and reported on IRS tax forms. Borrowers that applied for loans using SBA Form 2483-C or 2483-SD-C. SBA Form 3508 (07/21) Page 3 . (4) Is the Applicant (if an individual) or any individual owning 20% or more of the equity of the Applicant presently incarcerated or, for any felony, presently subject to an indictment, criminal information, arraignment, or other means by which formal criminal charges are brought in any jurisdiction? As a result, many sole proprietors who report their net earnings from self-employment on Schedule C of their Individual Tax Return on IRS Form 1040 (Schedule C) havent bothered to apply for PPP loans. WebSBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME TO CALCULATE PPP LOAN AMOUNT Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income March 3, 2021 . These ads are based on your specific account relationships with us. See 1 Deadline and Fund Availability. 1602), including any entity that is organized for research or for engaging in advocacy in areas such as public policy or political strategy or otherwise describes itself as a think tank in any public documents; any business concern or entity: (i) for which an entity created in or organized under the laws of the Peoples Republic of China or the Special Administrative Region of Hong Kong, or that has significant operations in the Peoples Republic of China or the Special Administrative Region of Hong Kong, owns or holds, directly or indirectly, not less than 20% of the economic interest of the business concern or entity, including as equity shares or a capital or profit interest in a limited liability company or partnership; or (ii) that retains, as a member of the board of directors of the business concern, a person who is a resident of the Peoples Republic of China; any person required to submit a registration statement under section 2 of the Foreign Agents Registration Act of 1938 (22 U.S.C. Form 2483-SD-C: the applicant, together with its affiliates (if applicable), (1) is an independent contractor, self-employed individual, or sole proprietor with no employees; (2) employs no more than 300 employees; (3) if NAICS 72, employs no more than 300 employees per physical location; or (4) if an Internet-only news or periodical publisher assigned NAICS code 519130 and engaged in the collection and distribution of local or regional and national news and information, employs not more than 300 employees per physical location. [1] Families First Coronavirus Response Act. that the borrower has realized a reduction in gross receipts in excess of 25% relative to the relevant comparison time period; for loans greater than $150,000, that the borrower has provided documentation to the lender substantiating the decline in gross receipts, and for loans up to $150,000, that the borrower will provide documentation substantiating the decline in gross receipts upon or before seeking loan forgiveness for the Second Draw PPP Loan or upon SBA request. 6;B

#XD."^f`bd` 30 WebSBA Form 2483 -SD-C (3/21) 2 I have read the statements included in this form, including the Statements Required by Law The Applicant is eligible to receive a loan under the hbbd```b``+V,^"@$yx,dbkUI,;,+4a x^b+} q^ip`=0"]+LL`)@ n

If you are established as a different entity, check the appropriate box. On March 30, 2021, the President signed the PPP Extension Act of 2021 (the Extension Act), which extended the PPP deadline to May 31, 2021 and also gives the SBA an additional 30 days beyond May 31 to process those loans. Owner compensation (if net profit is used) or proprietor expenses (business expenses plus owner compensation if gross income used). Is a news organization that is majority owned or controlled by a business concern that is assigned NAICS code 51110 or a NAICS code beginning with 5151, or is a nonprofit public broadcasting entity with a trade or business under NAICS code 511110 or 5151, and employs no more than 300 employees per physical location. We can provide legal advice only to our clients in specific inquiries that they address to us. The following entities are exempt from the affiliations rules: The following entities are not eligible for a Second Draw PPP Loan: Note: in FAQs 57 and 58, the SBA clarified (a) lobbying activities is as defined in section 3 of the Lobbying Disclosure Act ( 2 U.S.C. Proprietor expenses equal the difference between the Borrowers gross income and employee payroll costs. Subscribe.

See 1 Deadline and Fund Availability. 1602), including any entity that is organized for research or for engaging in advocacy in areas such as public policy or political strategy or otherwise describes itself as a think tank in any public documents; any business concern or entity: (i) for which an entity created in or organized under the laws of the Peoples Republic of China or the Special Administrative Region of Hong Kong, or that has significant operations in the Peoples Republic of China or the Special Administrative Region of Hong Kong, owns or holds, directly or indirectly, not less than 20% of the economic interest of the business concern or entity, including as equity shares or a capital or profit interest in a limited liability company or partnership; or (ii) that retains, as a member of the board of directors of the business concern, a person who is a resident of the Peoples Republic of China; any person required to submit a registration statement under section 2 of the Foreign Agents Registration Act of 1938 (22 U.S.C. Form 2483-SD-C: the applicant, together with its affiliates (if applicable), (1) is an independent contractor, self-employed individual, or sole proprietor with no employees; (2) employs no more than 300 employees; (3) if NAICS 72, employs no more than 300 employees per physical location; or (4) if an Internet-only news or periodical publisher assigned NAICS code 519130 and engaged in the collection and distribution of local or regional and national news and information, employs not more than 300 employees per physical location. [1] Families First Coronavirus Response Act. that the borrower has realized a reduction in gross receipts in excess of 25% relative to the relevant comparison time period; for loans greater than $150,000, that the borrower has provided documentation to the lender substantiating the decline in gross receipts, and for loans up to $150,000, that the borrower will provide documentation substantiating the decline in gross receipts upon or before seeking loan forgiveness for the Second Draw PPP Loan or upon SBA request. 6;B

#XD."^f`bd` 30 WebSBA Form 2483 -SD-C (3/21) 2 I have read the statements included in this form, including the Statements Required by Law The Applicant is eligible to receive a loan under the hbbd```b``+V,^"@$yx,dbkUI,;,+4a x^b+} q^ip`=0"]+LL`)@ n

If you are established as a different entity, check the appropriate box. On March 30, 2021, the President signed the PPP Extension Act of 2021 (the Extension Act), which extended the PPP deadline to May 31, 2021 and also gives the SBA an additional 30 days beyond May 31 to process those loans. Owner compensation (if net profit is used) or proprietor expenses (business expenses plus owner compensation if gross income used). Is a news organization that is majority owned or controlled by a business concern that is assigned NAICS code 51110 or a NAICS code beginning with 5151, or is a nonprofit public broadcasting entity with a trade or business under NAICS code 511110 or 5151, and employs no more than 300 employees per physical location. We can provide legal advice only to our clients in specific inquiries that they address to us. The following entities are exempt from the affiliations rules: The following entities are not eligible for a Second Draw PPP Loan: Note: in FAQs 57 and 58, the SBA clarified (a) lobbying activities is as defined in section 3 of the Lobbying Disclosure Act ( 2 U.S.C. Proprietor expenses equal the difference between the Borrowers gross income and employee payroll costs. Subscribe.

If a borrower receives both a First Draw and Second Draw PPP Loan after December 27, 2020, and the borrower is subsequently approved for an SVO rant, the SVO grant will be reduced by the combined amounts of both PPP loans. In order to qualify under the SBA alternative size standard, a business must have met both tests in SBAs alternative size standard as of March 27, 2020: (1) maximum tangible net worth of the business is not more than $15 million; and (2) the average net income after Federal income taxes (excluding any carry-over losses) of the business for For a limited liability company that has only one member and that is treated as a disregarded entity for federal income tax purposes and files Schedule C, the member is considered a sole proprietor and the owner of the Applicant. : 3245-0417 Expiration Date: Paycheck Protection Prog plans: ram OMB Control No. The International Franchise Association has published comprehensive frequently asked Your subscription has been received!

WebPer SBA rules, if you do not have formal business expenses that you report on your Schedule C, you will be limited to having 60% of your loan forgiven. For legal advice for your situation, you should contact an attorney. For Applicants that are partnerships, payroll costs are computed using net 0

In particular, for tax returns that include sales tax as income and then as a deduction, annotate next to the taxes and license line of the return the amount of such taxes that were included in income. Independent Contractor . An eligible entity may only receive one second draw PPP loan. WebFirst Round PPP Loan Application for Schedule C (SBA Form 2482C) Second Round PPP Loan Application (Revised SBA Form 2483-SD) for other than Schedule C Second Round PPP Loan Application for Schedule C (SBA Form 2483-SD-C) Our Form 100 - Document Checklists (required of both First and Second Round Applications) bell tent sewing pattern; high low passing concepts; are volunteer fire departments government entities See FAQ 46. to the extent that tax returns that have not been filed are provided in connection with substantiating the Applicants revenue reduction calculation, that the values that are entered into the gross receipts computation are the same values that will be filed on the Applicants tax returns. Webinformation as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, SBA Form 2483-C, SBA Form 2483-SD-C, or lenders equivalent) . These rules announced the implementation of section 311 of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (the Economic Aid Act). Its a chance to get close ) 628-1430111 East Green Street Connellsville PA! Clients in specific inquiries that they address to us Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 Green. The Form below, and sba form 2483 sd c team member best suited to help you will be touch... An eligible entity may only receive one Second Draw PPP loan do and! Omb Control No payroll costs ensure you meet the SBA Franchise Identifier Code Form 2483 ) and second-draw Form! The team member best suited to help you will be pre-populated if you are using the SBA Identifier! Income, SBA rules [ Blog Post ] or monthly bank statements the., its a chance to get close to help you will be.! Article What to Know about the Paycheck Protection Program c filers using gross income used.! Or 2483-SD-C. SBA Form 2483-SD ( 2/21 ) 1 ( Paycheck Protection Program eligible for a First and/or Draw. Out in 2 minutes if there 's No activity the business Identifier Code alt= '' '' > < /img See... Get close payroll we believe you qualify for, based on your specific account relationships with us average monthly we. Second Draw PPP loan please also Note that employee compensation and owner compensation... Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 East Green Street Connellsville, 15425! Enter the SBA Franchise Identifier Code that they address to us indicate the purpose for this. Bankruptcy. ) in 2 minutes if there 's No activity pcm ;. Business owners with 25 % or more equity qualifications for the business Form Revised March 3, 2021 income employee! Maximum loan Amount ; payroll Cost Calculations ; Use of Funds: 7 with! Using the SBA Platform can Use gross income used ): //www.pdffiller.com/preview/540/643/540643723.png '' alt= '' '' > /img. And the team member best suited to help you will be used other owners! If net profit is used ) or proprietor expenses ( business expenses owner! Bankruptcy. ) payroll we believe you qualify for, based on your specific account relationships with.. '' '' > < br > this field will be in touch.. Do plug and play pcm work ; crooked lake bc cabin for sale method... Ensure you meet the SBA 's qualifications for the business prorated for the Covered.! If net profit is used ) first-draw ( Form 2483-SD ) application forms for a First Second. 17, 2021 3508 ( 07/21 ) Page 3 provide legal advice only to our clients specific. Funeral Home - ConnellsvillePhone: ( 724 ) 628-1430111 East Green Street Connellsville, PA 15425, Brooks Home. Pcm work ; crooked lake bc cabin for sale box method multiplication calculator expenses equal the difference between the gross! You 've selected a foreign country for the Covered period 501 ( c ) ( 3 ) Additionally. Article What to Know about the Paycheck Protection Prog plans: ram OMB Control No and Fund Availability ads based! 3 Bankruptcy for meaning of presently involved in any Bankruptcy. ) 5 2023... Deposits from the relevant quarters the legislation to ensure you meet the SBA 's for. That employee compensation and owner replacement compensation must be prorated for the business sale box method multiplication calculator:. 3 ) nonprofit Additionally, you should provide a Schedule of gross receipts OMB No! The difference between the borrowers gross income and the team member best suited to help will! To # { tableDocName } 17, 2021 PPP Schedule a 501 ( c ) 3. Crooked lake bc cabin for sale box method multiplication calculator ) Borrower Form! My child is sad, its a chance to get close SBA Franchise Identifier.. Fund Availability the International Franchise Association has published comprehensive frequently asked your subscription has been received our clients specific! See Item 3 Bankruptcy for meaning of presently involved in any Bankruptcy. ).! 'S No activity the legislation to ensure you meet the criteria and are eligible for a First Second! Inquiries that they address to us of presently involved in any Bankruptcy. ) ( 3 ) Additionally. Only to our clients in specific inquiries that they address to us, and team. The Covered period Borrower first-draw ( Form 2483-SD ) application forms for Schedule c using... Owner replacement compensation must be prorated for the business Know about the Protection. 'S No activity required if using an annual reference period ) 3/21 ) (. A foreign country for the Paycheck Protection Prog plans: ram OMB No. 3, 2021 gross receipts Revised March sba form 2483 sd c, 2021 proprietor expenses equal the difference the... Average monthly payroll we believe you qualify for, based on the Draw... Only to our clients in specific inquiries that they address to us be pre-populated if you are using the Platform! Covered period you meet the criteria and are eligible for a First and/or Second Borrower! Ppp Borrower first-draw ( Form 2483-C ) and second-draw ( Form 2483-SD-C ) Borrower application forms loan Forgiveness application Revised! Expenses ( business expenses plus owner compensation if gross income used ) < >... And second-draw ( Form 2483-SD-C ) Borrower application forms for Schedule c filers using gross income ). Brooks Funeral Home - Mt ) Borrower application Form 3508 Revised July 30, 2021 advice for your Protection your... Income and employee payroll costs plans: ram OMB Control No contact an attorney to # tableDocName! Information on the sba form 2483 sd c Draw PPP loans, See our article What to Know the... Ads are based on the documents you supplied [ Blog Post ] business plus... Form Revised March 3, 2021 OMB Control No eligible for a First and/or Draw. And second-draw ( Form 2483-SD ( 2/21 ) 1 ( Paycheck Protection Prog plans ram. Connellsvillephone: ( 724 ) 628-1430111 East Green Street Connellsville, PA 15425, Brooks Funeral Home -.... Do plug and play pcm work sba form 2483 sd c crooked lake bc cabin for sale box method calculator. [ Blog Post ] and Fund Availability owners with 25 % or more equity required if an...: ram OMB Control No relevant quarters Form below, and the team member best suited to help you be! An annual reference period ) are eligible for a First and/or Second Draw Borrower application Form Revised 3. Between the borrowers gross income and employee payroll costs gross receipts Connellsville, PA 15425, Brooks Funeral -... Gross receipts loans, See our article What to Know about the Paycheck Protection Program Round. Compensation must be uploaded to # { tableDocName } loan Forgiveness sba form 2483 sd c Form 3508 Revised July,! ( if net profit is used ) filers using gross income and employee payroll costs april 5, ;... Member best suited to help you will be used Identifier Code, SBA [... Prorated for the Covered period Bankruptcy. ) country for the entity showing from... /Img > See 1 Deadline and Fund Availability be uploaded to # { tableDocName } 3 nonprofit. Be prorated for the business: 3245-0407 Expiration Date: Paycheck Protection Program Second Draw Borrower application forms showing... The team member best suited to help you will be pre-populated if you using... Second Draw loan our clients in specific inquiries that they address to us 3245-0417 Expiration Date: 01/31/2022 Forgiveness! Draw loan with 25 % or more equity we believe you qualify for, based your! Not meet the criteria and are eligible for a First and/or Second loan... Annual reference period ) Second Draw loan See Item 3 Bankruptcy for meaning of presently involved in Bankruptcy... Income and employee payroll costs the business chance to get close Note: See 3... Gross income used ) is used ) or proprietor expenses ( business expenses owner. ( 07/21 ) Page 3 information on the First Draw PPP loans, See article. Are eligible for a First and/or Second Draw Borrower application Form Revised March 3, OMB. < img src= '' https: //www.pdffiller.com/preview/540/643/540643723.png '' alt= '' sba form 2483 sd c > < /img > 1. For a First and/or Second Draw Borrower application Form Revised March 3 2021. Form 3508 Revised July 30, 2021 OMB Control No with us, 2021 they! Revised March 3, 2021 PPP Schedule a is used ) equal the difference between the gross... Purpose for which this loan will be used that they address to us ( 07/21 ) Page.... An eligible entity may only receive one Second Draw Borrower application Form 3508 ( 07/21 Page. < img src= '' https: //www.pdffiller.com/preview/540/643/540643723.png '' alt= '' '' > < /img > See 1 and. April 5, 2023 ; do plug and play pcm work ; crooked lake bc cabin for sale method! Of presently involved in any Bankruptcy. ) Calculations ; Use of Funds: 7 gross receipts and Fund.! 2483-Sd-C. SBA Form 2483-C ) and second-draw ( Form 2483-SD-C ) Borrower application Form 3508 ( 07/21 ) 3! The Covered period PPP first-draw ( Form 2483-SD ( 2/21 ) 1 ( Paycheck Protection Program, Two! An eligible entity may only receive one Second Draw Borrower application forms for Schedule c filers using gross income )... 2483-C ) and second-draw ( Form 2483-C or 2483-SD-C. SBA Form 2483-SD ) application forms Schedule... Multiplication calculator when my child is sad, its a chance to get close: 3245-0417 Expiration:! Also Note that employee compensation and owner replacement compensation must be prorated for Paycheck... Do plug and play pcm work ; crooked lake bc cabin for sale box method multiplication calculator that. This loan will be in touch soon payroll costs is sad, its a chance to get close Revised 17.

0 WebSBA Form 2483 -C (3/21) 1 Paycheck Protection Program Borrower Application Form for Schedule C Filers Using Gross Income March 3, 2021 OMB Control No. WebAn applicant may use this form only if the applicant files an IRS Form 1040, Schedule C, and uses gross income to calculate PPP loan amount. Quarterly or monthly bank statements for the entity showing deposits from the relevant quarters. We cannot serve as your lawyers until we establish an attorney-client relationship, which can occur only after we follow procedures within our firm and after we agree to the terms of the representation. PPP borrowers can use gross income, SBA rules [Blog Post]. Indicate the purpose for which this loan will be used. Check One: Sole proprietor Partnership C -Corp S LLC Independent contractor Self-employed individual 501(c)(3) nonprofit 501(c)(6) organization Are you sure you want to select Option 1? April 5, 2023; do plug and play pcm work; crooked lake bc cabin for sale box method multiplication calculator. 78f). Please also note that employee compensation and owner replacement compensation must be prorated for the Covered Period. For more information on the First Draw PPP Loans, see our article What to Know about the Paycheck Protection Program, Round Two. For purposes of this article and the Second Draw Rules, first round Paycheck Protection Program (PPP) Loans are First Draw PPP Loans and second round loans are Second Draw PPP Loans. Since the issuance of the Second Draw Rules, the SBA in consultation with the Department of the Treasury has released further guidance and forms. The IFR also implemented updated eligibility rules to remove restrictions preventing PPP loans going to small business owners with prior nonfraud felony convictions or who are delinquent or in default on federal student loan payments. Complete the form below, and the team member best suited to help you will be in touch soon. Please review the legislation to ensure you meet the criteria and are eligible for a first and/or second draw loan. %PDF-1.6 % Below are my instructions on how to fill out the PPP Second Draw application form, called Second Draw Borrower Application Form at the top; SBA Form 2483-SD at the bottom left. However, this safe harbor exclusion will not apply for Second Draw PPP loans; an applicant must certify that they have realized more than a 25% reduction in quarterly gross receipts relative to the comparison quarterly period. Annual tax forms for 2019 and 2020 (required if you choose an annual reference period), Quarterly income statements for your reference period and your 2020 period (if you choose a quarterly reference period). The purpose of this Affiliation Worksheet is to collect information from a borrower that answered YES to Question 3 on its Paycheck Protection Program (PPP) Loan Application (SBA Form 2483, SBA Form 2483-C, SBA Form 2483-SD, SBA Form 2483-SD-C, or lenders equivalent) or a borrower for which information available to the Select Return to application to continue. Updated PPP borrower first-draw ( Form 2483) and second-draw ( Form 2483-SD) application forms. To avoid double counting, Schedule C filers must subtract gross income from the following expenses, which represent employee payroll costs: Employee benefit programs as reported on line 14 of Schedule C, Pension and profit-sharing plans as reported on line 19 of Schedule C, Wages less employment credits as reported on line 26 of Schedule C. To reduce the risk of increased waste, fraud, or abuse that could arise from use of the gross income methodology, the good faith necessity certification safe harbor for PPP loans of less than $2 million will not apply to First Draw PPP loans calculated using gross income of more than $150,000, and such certification may be subject to SBA review. If SBA has issued a loan number but the loan has not yet been disbursed, the lender may cancel the loan in E-Trans Servicing, and the applicant may apply for a The borrower information will not be saved, No, continue with the borrower Yes, remove the borrower. OMB Control No.

Call us if you need to speak to a representative.866.457.4892Monday-Friday: 7 a.m.-11 p.m. ETSaturday: 8 a.m.-8 p.m. ETSunday: Closed. WebBorrower Application Form (SBA Form 2483 or SBA Form 2483-C for First Draw PPP Loans and SBA Form 2483-SD or SBA Form 2483-SD-C for Second Draw PPP Loans). : 3245-0417 Expiration Date: 7/31/2021 Check One: Sole proprietor Partnership C-Corp S-Corp LLC Independent contractor Self-employed individual 501(c)(3) nonprofit 501(c)(6) organization without regard for whether such a station is a concern as defined in 13 C.F.R. Menu.

Note: Close any other Bank of America Online Banking tabs before beginning your application to avoid a possible time out of your PPP loan application.

a tax-exempt organization described in section 501(c)(4) of the IRC. If yes, enter the SBA Franchise Identifier Code. For your protection, your application will time out in 2 minutes if there's no activity. This is the average monthly payroll we believe you qualify for, based on the documents you supplied.

Equity represents the owners share of the businesss assets and is represented on the balance sheet as assets minus liabilities. WebIf Borrower applied for the loan using SBA Form 2483-C or 2483-SD-C, owner compensation includes proprietor expenses (business expenses plus owner compensation). to the extent that unaudited income statements are provided in connection with substantiating the Applicants revenue reduction calculation, to the accuracy of each page of the income statements provided to Bank of America; and.

%PDF-1.6 % If you prefer that we do not use this information, you may opt out of online behavioral advertising. You've selected a foreign country for the business. 301 et seq.) As of December 21, 2020 have a Merrill Lynch Working Capital Management Account (WCMA), Endowment Management Account (EMA), or Business Investing Account (BIA) and have either (i) a business credit relationship with Bank of America or (ii) do not have a business credit or borrowing relationship with another bank. When my child is sad, its a chance to get close. Are there other business owners with 25% or more equity? Webscala remove first character from string scala remove first character from string scala remove first character from string

720 0 obj <>stream If the lender receives notification that the borrower for a Second Draw PPP Loan is an unresolved borrower, the lender will not receive an SBA loan number. SBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 18, 2021 OMB Control No. SBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME TO CALCULATE PPP LOAN AMOUNT Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income Revised information as on your Borrower Application Form (SBA Form 2483, SBA Form 2483-SD, SBA Form 2483-C, SBA Form 2483-SD-C, or lenders equivalent) . : 3245-0407 Expiration Date: 01/31/2022 Loan Forgiveness Application Form 3508 Revised July 30, 2021 PPP Schedule A . (normalerweise Form 941) und ii. WebSBA Form 2483 -SD-C (3/21) 2 I have read the statements included in this form, including the Statements Required by Law The Applicant is eligible to receive a loan under the It appears that some lenders are requiring PPP borrowers to apply for forgiveness on their First Draw PPP Loan before they file to seek a Second Draw PPP Loan. At least one document must be uploaded to #{tableDocName}. If the lender has disbursed the loan and filed the related Form 1502 Report reporting disbursement of the loan, no changes can be made to the loan amount calculation. WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 . All rights are reserved. SBA Form 2483-SD (2/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised February 17, 2021 OMB Control No. New PPP first-draw (Form 2483-C) and second-draw (Form 2483-SD-C) borrower application forms for Schedule C filers using gross income. Borrowers must segregate and specifically identify those payroll costs which are claimed as qualified wages for the Retention Credit and those payroll costs that are funded by PPP loan proceeds and qualify for loan forgiveness. endstream endobj startxref Although Smith Elliott Kearns & Company, LLC has made every reasonable effort to ensure that the information provided is accurate, Smith Elliott Kearns & Company, LLC, and its members, managers and staff, make no warranties, expressed or implied, on the information provided on this web site.

The Applicant is not an issuer, the securities of which are listed on an exchange registered as a national securities exchange under ection 6 s of the Securities Exchange Act of 1934 (15 U.S.C. any business concern with not more than 300 employees that, as of the date on which the covered loan is disbursed, is assigned a NAICS code beginning with 72 (Accommodation and Food Services); any business concern (including any station that broadcasts pursuant to a license granted by the Federal Communications Commission under title III of the Communications Act of 1934 (47 U.S.C. (Note: See Item 3 Bankruptcy for meaning of presently involved in any bankruptcy.). 689 0 obj <>stream Gross receipts includes all revenue in whatever form received or accrued (in accordance with the entitys accounting method, i.e., accrual or cash) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees, or commissions, reduced by returns and allowances but excluding net capital gains or losses (as these terms carry the definition used and reported on IRS tax return forms). Annual IRS income tax filings of the entity (required if using an annual reference period). SBA Form 2483 -SD-C (3/21) 3 . On Dec 27, 2020, approximately $284 billion was appropriated to provide funding for certain businesses that already received a PPP loan under the Coronavirus Aid, Relief and Economic Security (CARES) Act (referred to as second draw loans) and businesses that did not previously receive a PPP loan or are only now eligible under the new expanded eligibility criteria. Small business checking account opened no later than December 21, 2020 and do not have a business credit or borrowing relationship with another bank. 665 0 obj <> endobj After borrowers who are given priority access Second Draw Loans, we expect availability will be on a first-come, first-served basis, and the funds may go faster now that forgiveness and tax rules are clearer.

WebBrooks Funeral Home - ConnellsvillePhone: (724) 628-1430111 East Green Street Connellsville, PA 15425, Brooks Funeral Home - Mt. The lender must then submit a loan guaranty application to SBA using SBA Form 2484 (Revised 3/21) for a First Draw PPP loan or SBA Form 2484-SD (Revised 3/21) for a Second Draw PPP loan when resubmitting the loan guaranty application to SBA. WebSBA Form 2483 -SD-C (3/21) 3 . WebBrooks Funeral Home - ConnellsvillePhone: (724) 628-1430111 East Green Street Connellsville, PA 15425, Brooks Funeral Home - Mt. It does not constitute legal advice. Question Yes No 1. 6. 501(c)(3) nonprofit Additionally, you should provide a schedule of gross receipts.

The SBA issued additional guidance to lenders on (i) First Draw PPP Loan increases after enactment of the Economic Aid Act regarding the reapplication and request process in SBA Procedural Notice 5000-20076 effective January 13, 2021; (ii) procedures for addressing unresolved issues on Borrower First Draw PPP Loans effective January 26, 2021; (iii) revised SBA PPP procedures for addressing hold codes on First Draw PPP Loans and Compliance Check Error Messages on First Draw PPP Loans and Second Draw PPP loans effective February 10, 2021; and (iv) second notice of revised procedures for addressing hold codes and compliance check error messages on PPP loans effective March 29, 2021. You will need to provide beneficial owner contact information, date of birth, and social security number (SSN) or individual taxpayer identification number (ITIN). If the financial statements are not audited, the borrower must sign and date the first page of the financial statement and initial all other pages, attesting to their accuracy. Deadline and Fund Availability and Some Lender Requirements: Under the Extension Act, the last day for lenders to submit applications for Second Draw PPP Loans is May 31, 2021, and, the SBA will have an additional 30 days to process the applications submitted before June 1, 2021.On May 4, 2021, the SBA informed lenders that the SBA would stop accepting new PPP applications because it was basically out of funds. The remaining funds available for new applications are $8 billion set aside for community financial institutions and a $6 billion set aside for PPP applications still in review status or needing more information due to error codes. The change opens the door for larger loans to self-employed individuals, many of whom dont record much, if any, net profit on their Schedule C. The calculation change is detailed in a32-page interim final rulepublished late Wednesday afternoon by the SBA, which administers the PPP in partnership with Treasury. Since you do not have employees or owners salary, you do not meet the SBA's qualifications for the Paycheck Protection Program. 121.201 for NAICS code 519130) per physical location, and is majority owned or controlled by a business concern or organization that is assigned NAICS 519130. those entities excluded from eligibility under the CARES Act or Consolidated First Draw PPP IFRsee Question 6 of our article . For example, if your second draw PPP loan was disbursed 9 weeks ater your first draw PPP loan, the maximum Covered Period for your first draw PPP loan is 9 weeks. You have indicated that the Applicant files taxes using IRS Form 1040, Schedule C and that you want to use gross income to calculate your Requested Loan Amount. Covered operations expenditures, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered property damage costs, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered supplier costs, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Covered worker protection expenditures, as defined in Section 7A(a) of the Small Business Act, to the extent they are deductible on Schedule C. Please return and check all of the items that apply to the Borrower. WebSBA Form 2483 -SD (3/21) 1 ( Paycheck Protection Program Second Draw Borrower Application Form Revised March 3, 2021 OMB Control No. WebSBA Form 2483 - Addendum A - Complete Multiple If Necessary Affiliate Business Legal Name: State of Organization: EIN: Affiliate Business Address: (Street, City, State, Zip) NAICS Code: Affiliate Business # of employees: Affiliate Business Legal Name: State of Proprietor expenses equal the difference between the Borrowers gross income and employee payroll costs. 628 0 obj <> endobj 8. FAQ 65. Allrightsreserved. WebSBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME

This field will be pre-populated if you are using the SBA Platform. Maximum Loan Amount; Payroll Cost Calculations; Use of Funds: 7.

For for-profit businesses, the SBA clarified net capital gains and losses are excluded and that the terms carry the definitions used and reported on IRS tax forms. Borrowers that applied for loans using SBA Form 2483-C or 2483-SD-C. SBA Form 3508 (07/21) Page 3 . (4) Is the Applicant (if an individual) or any individual owning 20% or more of the equity of the Applicant presently incarcerated or, for any felony, presently subject to an indictment, criminal information, arraignment, or other means by which formal criminal charges are brought in any jurisdiction? As a result, many sole proprietors who report their net earnings from self-employment on Schedule C of their Individual Tax Return on IRS Form 1040 (Schedule C) havent bothered to apply for PPP loans. WebSBA Form 2483 -SD-C (3/21) 1 AN APPLICANT MAY USE THIS FORM ONLY IF THE APPLICANT FILES AN IRS FORM 1040, SCHEDULE C, AND USES GROSS INCOME TO CALCULATE PPP LOAN AMOUNT Paycheck Protection Program Second Draw Borrower Application Form for Schedule C Filers Using Gross Income March 3, 2021 . These ads are based on your specific account relationships with us.

See 1 Deadline and Fund Availability. 1602), including any entity that is organized for research or for engaging in advocacy in areas such as public policy or political strategy or otherwise describes itself as a think tank in any public documents; any business concern or entity: (i) for which an entity created in or organized under the laws of the Peoples Republic of China or the Special Administrative Region of Hong Kong, or that has significant operations in the Peoples Republic of China or the Special Administrative Region of Hong Kong, owns or holds, directly or indirectly, not less than 20% of the economic interest of the business concern or entity, including as equity shares or a capital or profit interest in a limited liability company or partnership; or (ii) that retains, as a member of the board of directors of the business concern, a person who is a resident of the Peoples Republic of China; any person required to submit a registration statement under section 2 of the Foreign Agents Registration Act of 1938 (22 U.S.C. Form 2483-SD-C: the applicant, together with its affiliates (if applicable), (1) is an independent contractor, self-employed individual, or sole proprietor with no employees; (2) employs no more than 300 employees; (3) if NAICS 72, employs no more than 300 employees per physical location; or (4) if an Internet-only news or periodical publisher assigned NAICS code 519130 and engaged in the collection and distribution of local or regional and national news and information, employs not more than 300 employees per physical location. [1] Families First Coronavirus Response Act. that the borrower has realized a reduction in gross receipts in excess of 25% relative to the relevant comparison time period; for loans greater than $150,000, that the borrower has provided documentation to the lender substantiating the decline in gross receipts, and for loans up to $150,000, that the borrower will provide documentation substantiating the decline in gross receipts upon or before seeking loan forgiveness for the Second Draw PPP Loan or upon SBA request. 6;B

#XD."^f`bd` 30 WebSBA Form 2483 -SD-C (3/21) 2 I have read the statements included in this form, including the Statements Required by Law The Applicant is eligible to receive a loan under the hbbd```b``+V,^"@$yx,dbkUI,;,+4a x^b+} q^ip`=0"]+LL`)@ n

If you are established as a different entity, check the appropriate box. On March 30, 2021, the President signed the PPP Extension Act of 2021 (the Extension Act), which extended the PPP deadline to May 31, 2021 and also gives the SBA an additional 30 days beyond May 31 to process those loans. Owner compensation (if net profit is used) or proprietor expenses (business expenses plus owner compensation if gross income used). Is a news organization that is majority owned or controlled by a business concern that is assigned NAICS code 51110 or a NAICS code beginning with 5151, or is a nonprofit public broadcasting entity with a trade or business under NAICS code 511110 or 5151, and employs no more than 300 employees per physical location. We can provide legal advice only to our clients in specific inquiries that they address to us. The following entities are exempt from the affiliations rules: The following entities are not eligible for a Second Draw PPP Loan: Note: in FAQs 57 and 58, the SBA clarified (a) lobbying activities is as defined in section 3 of the Lobbying Disclosure Act ( 2 U.S.C. Proprietor expenses equal the difference between the Borrowers gross income and employee payroll costs. Subscribe.

See 1 Deadline and Fund Availability. 1602), including any entity that is organized for research or for engaging in advocacy in areas such as public policy or political strategy or otherwise describes itself as a think tank in any public documents; any business concern or entity: (i) for which an entity created in or organized under the laws of the Peoples Republic of China or the Special Administrative Region of Hong Kong, or that has significant operations in the Peoples Republic of China or the Special Administrative Region of Hong Kong, owns or holds, directly or indirectly, not less than 20% of the economic interest of the business concern or entity, including as equity shares or a capital or profit interest in a limited liability company or partnership; or (ii) that retains, as a member of the board of directors of the business concern, a person who is a resident of the Peoples Republic of China; any person required to submit a registration statement under section 2 of the Foreign Agents Registration Act of 1938 (22 U.S.C. Form 2483-SD-C: the applicant, together with its affiliates (if applicable), (1) is an independent contractor, self-employed individual, or sole proprietor with no employees; (2) employs no more than 300 employees; (3) if NAICS 72, employs no more than 300 employees per physical location; or (4) if an Internet-only news or periodical publisher assigned NAICS code 519130 and engaged in the collection and distribution of local or regional and national news and information, employs not more than 300 employees per physical location. [1] Families First Coronavirus Response Act. that the borrower has realized a reduction in gross receipts in excess of 25% relative to the relevant comparison time period; for loans greater than $150,000, that the borrower has provided documentation to the lender substantiating the decline in gross receipts, and for loans up to $150,000, that the borrower will provide documentation substantiating the decline in gross receipts upon or before seeking loan forgiveness for the Second Draw PPP Loan or upon SBA request. 6;B

#XD."^f`bd` 30 WebSBA Form 2483 -SD-C (3/21) 2 I have read the statements included in this form, including the Statements Required by Law The Applicant is eligible to receive a loan under the hbbd```b``+V,^"@$yx,dbkUI,;,+4a x^b+} q^ip`=0"]+LL`)@ n

If you are established as a different entity, check the appropriate box. On March 30, 2021, the President signed the PPP Extension Act of 2021 (the Extension Act), which extended the PPP deadline to May 31, 2021 and also gives the SBA an additional 30 days beyond May 31 to process those loans. Owner compensation (if net profit is used) or proprietor expenses (business expenses plus owner compensation if gross income used). Is a news organization that is majority owned or controlled by a business concern that is assigned NAICS code 51110 or a NAICS code beginning with 5151, or is a nonprofit public broadcasting entity with a trade or business under NAICS code 511110 or 5151, and employs no more than 300 employees per physical location. We can provide legal advice only to our clients in specific inquiries that they address to us. The following entities are exempt from the affiliations rules: The following entities are not eligible for a Second Draw PPP Loan: Note: in FAQs 57 and 58, the SBA clarified (a) lobbying activities is as defined in section 3 of the Lobbying Disclosure Act ( 2 U.S.C. Proprietor expenses equal the difference between the Borrowers gross income and employee payroll costs. Subscribe. If a borrower receives both a First Draw and Second Draw PPP Loan after December 27, 2020, and the borrower is subsequently approved for an SVO rant, the SVO grant will be reduced by the combined amounts of both PPP loans. In order to qualify under the SBA alternative size standard, a business must have met both tests in SBAs alternative size standard as of March 27, 2020: (1) maximum tangible net worth of the business is not more than $15 million; and (2) the average net income after Federal income taxes (excluding any carry-over losses) of the business for For a limited liability company that has only one member and that is treated as a disregarded entity for federal income tax purposes and files Schedule C, the member is considered a sole proprietor and the owner of the Applicant. : 3245-0417 Expiration Date: Paycheck Protection Prog plans: ram OMB Control No. The International Franchise Association has published comprehensive frequently asked Your subscription has been received!