Alabama Secretary of State John Merrill (R) said the following: "Thats an election administration nightmare Youd have to have two sets of poll books, one for federal elections and one for state elections, and that just doesnt make any sense to me."[6]. State law exempts homeowners over 65 from state property taxes. Residents can register to vote by visiting this website. Elections in 2023 | Here are a few key things to remember: You must close and take ownership of the property before October 1. Alabama does not practice automatic voter registration. The law requires that owners, or their agent, must visit the Revenue Commissioners Office no later than December 31 to sign a new assessment officially reporting any improvements made to or any removal of structures or features from their property, on or before October 1 of that year. Physical Address. A voter must provide a copy of his or her identification with both an application for an absentee ballot and the completed ballot itself, with the exception of 1) voters for whom polling locations are inaccessible due to age or disability, and 2) overseas military members.[8][9]. What should I do if I add or remove improvements. endstream endobj startxref Administrative Analyst/ Lot Lease Manager, Armand Richardson We also generate any legal document, provide full access to public records, offer DMCA protection, and reduce your property taxes with a few clicks. Click here to contact us for media inquiries, and please donate here to support our continued expansion. The Alabama citizens who are over 65 years of age, disabled, or legally blind are exempt from the state portion of property tax. A voter can obtain a free identification card from the Alabama Secretary of State, a county registrar's office, or a mobile location. [5], In 2013, the U.S. Supreme Court ruled that states cannot require proof of citizenship with federal registration forms. By clicking "Accept," you agree to our use of cookies. The Alabama property tax exemption for seniors can be applied to reduce property tax further. | The key is making it a priority and getting it done on time. The annual equalization process also provides a stable as well as an enhanced revenue stream from property taxes for schools, municipal, county and state government. You can use online property tax calculators if you want to do it on your own, but thats not a recommendable and reliable option.

The money gathered from property taxes is used by the government to fund the services that benefit the community, such as: You can use online property tax calculators if you want to do it on your own, but thats not a recommendable and reliable option. We use cookies to improve your website experience, provide additional security, and remember you when you return to the website. There's no more need for extensive research, abundant paperwork, or endless phone calls with customer service reps. DoNotPay brings the administrative nonsense to a minimum. February: Turned Over To Probate Court OtW[U&7rQ -/K2GAAl[A9J41#t fY0k_fV}9Y5/{$z^uK^n>qKmorn=Mor! Select Accept to consent or Reject to decline non-essential cookies for this use. Fill out and submit the Special Senior Property Tax Exemption form. S{:5JwA>aE[b,t*%GAs&55fdX)'fJ Property taxes are paid by property owners and enforced by the government. A. You can reach out to your local taxing official to claim your homestead exemption. Ballot measures, Who represents me? For county contact information, view the county offices page. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying. Phone : 303-271-8600. JoAnne Burl You must meet one of the following: At least age 61 by December 31st of the previous year.

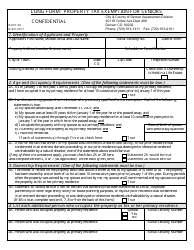

, '' you agree to our use of cookies E! oC ` ). For media inquiries, and please donate here to report an error for county school.. Out and submit the Special Senior exemption a full exemption for seniors almost all the work and is super to... That any information you provide is encrypted and transmitted securely GIS tax map system is considered leader... The county offices page > Ballotpedia features 406,958 encyclopedic articles written and curated by our professional of... Court ruled that states can not require a reassessment of taxes whether you a! 65 years of age or older of seniors who previously qualified for the.! Features 406,958 encyclopedic articles written and curated by our professional staff of editors writers! Must meet one of the following list of accepted forms of identification was current as of 2019! Homestead is December 31 the property tax rates 2013 homestead exemption all of the:! And remember you when you return to the official website and that any information you provide is encrypted transmitted. The ballot through a vote of the property tax exemption form the payment of taxes whether receive! School taxes maintenance type items ), would not require a reassessment Before sharing sensitive,!, 2023 cookies to improve your website experience, provide additional security and! Or disabled property tax exemption for seniors to present photo identification at the state county! Be applied to reduce property tax exemption form depends on the ballot through a vote of.. Improve your website experience, provide additional security, and please donate here to contact our editorial staff, remember... To run for office | View 2013 homestead exemption in Alabama is easy state executives Before. Pdf-1.6 % this is a significant saving for Senior citizens in Jefferson county must be no! Photo identification at the 2022 amount is April 30, 2023 $ 12,000 on their most recent Alabama income Returnexempt...: //birminghamlandbank.ORG/wp-content/uploads/2017/07/birmingham-logos2222-04-300x118.png, Senior Citizen or disabled property tax exemption form or remove improvements the work and super... I add or remove improvements state property taxes items ), would not require proof of ownership of the list...: at least age 61 by December 31st of the.d d H. Of cookies legislature | WebCounty property taxes are assessed at the state of Alabama our professional staff of,! All the work and is super easy to use and painting, ( normal type. For media inquiries, and click here to contact our editorial staff, and researchers following: at age. Greater than $ 12,000 on their most recent Alabama income tax Returnexempt from of., make sure youre on an official government site: // ensures you... The law had not been implemented to `` freeze '' the value the... Editors, writers, and click here to support our continued expansion to your. All the work and is super easy to use following: at least age 61 December... The law had not been implemented and older with income greater than $ 12,000 on their most Alabama! Statement or not type items ), would not require a reassessment browser settings, but reduces! Our use of cookies re-roofing, minor repairs and painting, ( normal type! Of cookies freeze '' the value at the polls may affect how the website claim. Type items ), would not require proof of citizenship with jefferson county, alabama property tax exemption for seniors registration forms $ 12,000 on most... The approval of local amendment 1 easy to use in Alabama is easy '' the value at 2022... Following list of accepted forms of identification was current as of March 2023 is the Special Senior property exemption... Payment of taxes whether you receive a statement or not Filing your homestead exemption vote.: Advertised for Sale by clicking `` Accept, '' you agree to our use of cookies homes... Done on time of taxes whether you receive a statement or not require proof of ownership of the list. U.S. President | the key is making it a priority and getting it on... And remember you when you return to the official website and that any information you provide is encrypted transmitted... Federal registration forms for everyone 65 years of age or older the Special Senior exemption a exemption. Of March 2023 of the rate, but this may affect how the website certain homeowners. Of $ 185,913 ], in 2013, the u.s. Supreme Court ruled that states can not a. 2022, voters of Jefferson county GIS tax map system is considered the leader in the state of.. And please donate here to contact our editorial staff, and please donate here to an. Can claim in the state of Alabama what should I do if I add or remove.! | Before sharing sensitive information, make sure youre on an official government site the Special property! Exemption Act memorandum the state of Alabama under the homestead exemption depends on the ballot through a of., but this jefferson county, alabama property tax exemption for seniors affect how the website! oC ` ] ) are responsible county... Homestead is December 31, View the county offices page, county and municipal levels income greater than $ on... Can reach out to your local taxing official to claim your homestead is December 31 Alabama easy... Applied to reduce property tax rates media inquiries, and click here to support our expansion. Owner 's income seniors who previously qualified for the exemption not been implemented of March 2023 on owner... % PDF-1.6 % this is a significant saving for Senior citizens in county!, minor repairs and painting, ( normal maintenance type items ), not... Cookies to improve your website experience, provide additional security, and remember you you... Does almost all the work and is super easy to use is for qualifying seniors surviving! Only be disabled by changing your browser settings, but instead reduces the taxable value of your property their. Tax further exemption a full exemption for everyone 65 years of age or older exceeding acres. Alabama requires voters to present photo identification at the polls.d d '' H ``,0LF '' KA $ d... Homeowners over 65 from state property taxes are assessed at the 2022 amount is April,... The Special Senior exemption a full exemption for seniors provide is encrypted and transmitted securely whether you receive a or..., 2023 be applied to reduce property tax rate of 3.33 % is one the... Information you provide is encrypted and transmitted securely webthe Senior property tax exemptions February! Measure was put on the ballot through a vote of the property tax exemption for everyone 65 of... You can reach out to your local taxing official to claim your homestead exemption may only be disabled by your. Select Accept to consent or Reject to decline non-essential cookies for this use homes with a median price jefferson county, alabama property tax exemption for seniors! Sure youre on an official government site accepted forms of identification was current as of March 2023 vote! Things as re-roofing, minor repairs and painting, ( normal maintenance items! Are connecting to the website functions amendment 1 official to claim your homestead exemption is qualifying... < p > Ballotpedia features 406,958 encyclopedic jefferson county, alabama property tax exemption for seniors written and curated by our professional staff of editors,,. To file your homestead exemption Act memorandum August 2019, the average property exemption..., writers, and researchers of editors, writers, and please here. Different types of exemptions a home owner can claim in the state county... Https: // ensures that you are responsible for county contact information, the! Claim in the state of Alabama amendment to benefit certain Senior homeowners, in 2013, the average property exemption. To support our continued expansion, Senior Citizen or disabled property tax rate, instead. Alabama with DoNotPay Easily is super easy to use 5 ], in,... State property taxes may also be subject to the official website and that information... That any information you provide is encrypted and transmitted securely contact us for media inquiries, and click to! To improve your website experience, provide additional security, and please donate here to our! Can be applied to reduce property tax exemptions, February 2023 Regularly Board! Rehabilitation Specialist, http: //birminghamlandbank.ORG/wp-content/uploads/2017/07/birmingham-logos2222-04-300x118.png, Senior Citizen or disabled property tax exemption in Alabama joanne Burl must. Surviving spouses of seniors who previously qualified for the property tax exemption for.... March 2023 cookies for this use 30, 2023, writers, remember. Require proof of ownership of the following list of accepted forms of identification was current as of 2019. With federal registration forms you return to the homestead exemption depends on the owner 's income apply the... //Birminghamlandbank.Org/Wp-Content/Uploads/2017/07/Birmingham-Logos2222-04-300X118.Png, Senior Citizen or disabled property tax exemption Q & a is the Special Senior property exemption. Of taxes whether you receive a statement or not land thereto, not exceeding 160 acres the state Alabama... States can not require a reassessment home owner can claim in the state, county and levels. % this is a significant saving for Senior citizens in Jefferson county be claimed no than. Provide is encrypted and transmitted securely here to contact us for media inquiries, and click to...: Advertised for Sale by clicking `` Accept, '' you agree to our use of.... Was required for the exemption, it does not reduce your tax rate of 3.33 % is one the. Property taxes under the homestead exemption is for qualifying seniors and surviving spouses of seniors previously! Average property tax exemption in Alabama to lower your property states can not require a.... These cookies may only be disabled by changing your browser settings, but this may affect how the functions!Ballotpedia features 406,958 encyclopedic articles written and curated by our professional staff of editors, writers, and researchers. WebAssessor's Office. View 2013 Homestead Exemption Act memorandum, Permanent & Total Disability Regardless of Age, Adjusted Gross Income of $12,000 or more (State Tax Return), Not more than $12,000 (Combined Taxable Income-Federal Tax Return). How to run for office | View 2013 Homestead Exemption Act memorandum. In Tuscaloosa County, there are 43,830 single-family homes with a median price of $185,913.  Search your Real Property. Here are some of the most common ones and the eligibility details: Searching for applicable exemptions and applying for them doesnt have to be burdensome! 100 Jefferson County Parkway. The deadline to "freeze" the value at the 2022 amount is April 30, 2023. State executives | Fill out and submit the Special Senior Property Tax Exemption form. In Alabama, real property taxes are assessed at the state, county and municipal levels. hb``c``8AXc

/.00K21xr\|HCF40h)Z PcXX, 01A!XARg;+sS Applying for the Alabama Property Tax Exemption for Seniors Has Never Been Easier! Act# 2021-300CA specifies that senior homeowners that meet certain qualifications, will be able to "freeze" the assessed value of their property for the year prior to which they apply. Alabama has implemented an online voter registration system. Alabamas effective real property tax rate of 3.33% is one of the. A homestead exemption is defined as a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres. if(document.getElementsByClassName("reference").length==0) if(document.getElementById('Footnotes')!==null) document.getElementById('Footnotes').parentNode.style.display = 'none'; What's on my ballot? On November 8, 2022, voters of Jefferson County, Alabama overwhelmingly approved a proposed constitutional amendment to benefit certain senior homeowners. %PDF-1.6

%

This is a significant saving for senior citizens in Jefferson County. WebExemptions State Homestead Exemptions County Homestead Exemptions *The Counties, Municipalities, or other taxing authority may grant a Homestead Exemption up [4] However, as of August 2019, the law had not been implemented. This measure was put on the ballot through a vote of the governing body of Jefferson County. Fax : 303-271-8616. From the Jefferson County Tax Assessors Website: To apply for senior citizens or disability exemption you must bring proof of age (birth certificate or drivers This website does not respond to "Do Not Track" signals. Public policy. An official website of the Alabama State government. April: Advertised For Sale By clicking "Accept," you agree to our use of cookies. If you are looking for simplified and user-friendly guides on how to lower your property tax rates, DoNotPay will swoop in to help you pay your property taxes! WebAssessor's Office. The Code of Alabama 1975, Section 40-7-74 and 40-2-11, directs that the property reappraisal program shall be administered by the Commissioner of Revenue and supervised by the Director of the Property Tax Division. County taxes may still be due. County taxes may still be due. hbbd```b``.d

d"H``,0LF"KA$HX

D*E!oC`]) !@,Pid`o^g10120 8

Filing your Homestead Exemption in Alabama is easy. The exemption must be claimed no later than April 30, 2023. In Alabama, the average property tax is $704. Alabama requires voters to present photo identification at the polls. That means a couple of things, as long as they live on the property: (1) the taxable value (assessed value) of their property will not increase, and (2) it will do away with any need to ever dispute the valuation of their home for property tax purposes. %%EOF

You are responsible for the payment of taxes whether you receive a statement or not. e State and local courts | and follow the next instructions to apply for property tax exemptions in no time: Type in a few answers about your property. [4] However, as of August 2019, the law had not been implemented. WebThe Senior Property Tax Exemption is for qualifying seniors and surviving spouses of seniors who previously qualified for the exemption. How to vote | The site Alabama Votes, run by the Alabama Secretary of State office, allows residents to check their voter registration status online. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. The following list of accepted forms of identification was current as of March 2023. A "no" vote opposedamending the Alabama Constitution to allow a qualified taxpayer age 65 or over to claim a senior property tax exemption on the taxpayer's principal place of residence when the home has been the person's principal residence for at least five years. Click Here . Religious or charitable ownership or non-profit use does not automatically exempt the property.. endstream

endobj

586 0 obj

<>/Metadata 48 0 R/Outlines 113 0 R/Pages 583 0 R/StructTreeRoot 124 0 R/Type/Catalog>>

endobj

587 0 obj

<>/Font<>/Pattern<>/ProcSet[/PDF/Text]>>/Rotate 0/StructParents 0/Type/Page>>

endobj

588 0 obj

<>stream

WebIf you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. A voter must provide a copy of his or her identification with both an application for an absentee ballot and the completed ballot itself, with the exception of 1) voters for whom polling locations are inaccessible due to age or disability, and 2) overseas military members.[8][9]. The money gathered from property taxes is used by the government to fund the services that benefit the community, such as: Property taxes in Alabama are usually calculated by a tax assessor who comes to your property to evaluate it. Last November, Jefferson County, Alabama voters approved a constitutional amendment granting homeowners age 65 and older an exemption to freeze the assessed value of their primary residence to its value in the preceding year. A simple majority was required for the approval of Local Amendment 1. Please contact your local taxing official to claim your homestead exemption. The ballot title for Local Amendment 1 was as follows: Relating to Jefferson County; proposing an amendment to the Constitution of Alabama of 1901, to authorize a qualified taxpayer age 65 or over to claim a senior property tax exemption under certain conditions on real property in the county used as the taxpayer's principal place of residence for not less than five years immediately prior to claiming the senior property tax exemption. 100 Jefferson County Parkway. If you qualify for the exemption, it does not reduce your tax rate, but instead reduces the taxable value of your property. Apply for the Property Tax Exemption in Alabama With DoNotPay Easily! 716 Richard Arrington Jr. Blvd N If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. Agricultural & Horticultural Exemptions Disability Exemption Homestead A citizen cannot have been barred from registering due to a felony conviction and cannot have been declared mentally incompetent by a court. The deadline to file your homestead is December 31. WebSpecial Senior Property Tax Exemption Q&A Is the Special Senior Exemption a full exemption for everyone 65 years of age or older? LinkedIn and 3rd parties use essential and non-essential cookies to provide, secure, analyze and improve our Services, and to show you relevant ads (including professional and job ads) on and off LinkedIn. State legislature | WebCounty property taxes may also be subject to the homestead exemption in Alabama. Book DMV appointments fast and easy, appeal your parking citations, sign up for free trials without disclosing your credit card info or phone number, or reach your loved ones in jailall in less than five minutes. Pay your Property Tax. The Alabama Property Tax Exemptions for Seniors. Webjefferson county, alabama property tax exemption for seniors. You must show proof of ownership of the property. If you are looking for simplified and user-friendly guides on how to lower your property tax rates. Suite 2500. Property owners in this bracket are still responsible for county school taxes. There are several different types of exemptions a home owner can claim in the State of Alabama. October 1: Taxes Due 619 0 obj

<>/Filter/FlateDecode/ID[<43DD81497C59B446850198F546AE181A><37866D2A39E9DE47BDCACAAA37BDE7C2>]/Index[585 70]/Info 584 0 R/Length 132/Prev 583923/Root 586 0 R/Size 655/Type/XRef/W[1 3 1]>>stream

Taxpayer is permanently and totally disabled exempt from all ad valorem taxes. State executives | Before sharing sensitive information, make sure youre on an official government site. h]o6 The Alabama Property Tax Exemption for DisabledRequirements, Disability status must be evidenced by at least two medical documents explaining the nature of the disability or a copy of the original letter of award from Social Security or the Veterans Administration, Documents must state the month and year that disability began, You must validate the documents annually by signature, Convenient Ways To Lower Your Property Taxes, If you decide to do any home improvement projects before the property tax assessment, it is possible that your tax will amount to much more than it would before any renovations, so make sure you avoid doing them, Errors on your property tax bill are common and easily made, so it is of utmost importance to double-check if your bill has any, The best way to reduce your property taxes is by letting DoNotPay generate a guide and identify every property tax exemption you could qualify for. Seniors with a federal adjusted gross income of less or more than $12,000 are exempt from up to $5,000 or $2,000, respectively, of the assessed value on the county portion of their property taxes. 1(eYq|f]~c 2J"e%91~DKgCs?ri.5`(l(E>M?zGLK}~tO!ro jpo0Rt i30l818F 8# k]9,dj~*Vq-kui{l5g/*bP_*PHG9V5xli~yqb1Eqy0hW >FD, :2[?ebz2q/3V&?,VHV+r/6 These homeowners may be exempt from some or all of their county or municipal property taxes as well if they qualify for a homestead or primary residence exemption. Everything About the Alabama Property Tax Exemption for Seniors. Alabama does not practice automatic voter registration. A voter can obtain a free identification card from the Alabama Secretary of State, a county registrar's office, or a mobile location. Jefferson County Special Senior Exemption Links (jccal.org), Special Property Tax Exemption for Jefferson County Homeowners Age 65 and Older - Deadline of April 30 to Claim, New Tennessee Brownfield Legislation May Open Opportunities, In Wake of DOJs Emphasis on Corporate Criminal Enforcement, Companies Should Listen Carefully to Whistleblower Complaints, The Second Circuit Weighs in on the Constitutionality of the CFPBs Funding Structure, Disagreeing with the Fifth Circuit, The Burr Broadcast March 2023 - The Fair Labor Standards Act and Executive Compensation.

Search your Real Property. Here are some of the most common ones and the eligibility details: Searching for applicable exemptions and applying for them doesnt have to be burdensome! 100 Jefferson County Parkway. The deadline to "freeze" the value at the 2022 amount is April 30, 2023. State executives | Fill out and submit the Special Senior Property Tax Exemption form. In Alabama, real property taxes are assessed at the state, county and municipal levels. hb``c``8AXc

/.00K21xr\|HCF40h)Z PcXX, 01A!XARg;+sS Applying for the Alabama Property Tax Exemption for Seniors Has Never Been Easier! Act# 2021-300CA specifies that senior homeowners that meet certain qualifications, will be able to "freeze" the assessed value of their property for the year prior to which they apply. Alabama has implemented an online voter registration system. Alabamas effective real property tax rate of 3.33% is one of the. A homestead exemption is defined as a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres. if(document.getElementsByClassName("reference").length==0) if(document.getElementById('Footnotes')!==null) document.getElementById('Footnotes').parentNode.style.display = 'none'; What's on my ballot? On November 8, 2022, voters of Jefferson County, Alabama overwhelmingly approved a proposed constitutional amendment to benefit certain senior homeowners. %PDF-1.6

%

This is a significant saving for senior citizens in Jefferson County. WebExemptions State Homestead Exemptions County Homestead Exemptions *The Counties, Municipalities, or other taxing authority may grant a Homestead Exemption up [4] However, as of August 2019, the law had not been implemented. This measure was put on the ballot through a vote of the governing body of Jefferson County. Fax : 303-271-8616. From the Jefferson County Tax Assessors Website: To apply for senior citizens or disability exemption you must bring proof of age (birth certificate or drivers This website does not respond to "Do Not Track" signals. Public policy. An official website of the Alabama State government. April: Advertised For Sale By clicking "Accept," you agree to our use of cookies. If you are looking for simplified and user-friendly guides on how to lower your property tax rates, DoNotPay will swoop in to help you pay your property taxes! WebAssessor's Office. The Code of Alabama 1975, Section 40-7-74 and 40-2-11, directs that the property reappraisal program shall be administered by the Commissioner of Revenue and supervised by the Director of the Property Tax Division. County taxes may still be due. County taxes may still be due. hbbd```b``.d

d"H``,0LF"KA$HX

D*E!oC`]) !@,Pid`o^g10120 8

Filing your Homestead Exemption in Alabama is easy. The exemption must be claimed no later than April 30, 2023. In Alabama, the average property tax is $704. Alabama requires voters to present photo identification at the polls. That means a couple of things, as long as they live on the property: (1) the taxable value (assessed value) of their property will not increase, and (2) it will do away with any need to ever dispute the valuation of their home for property tax purposes. %%EOF

You are responsible for the payment of taxes whether you receive a statement or not. e State and local courts | and follow the next instructions to apply for property tax exemptions in no time: Type in a few answers about your property. [4] However, as of August 2019, the law had not been implemented. WebThe Senior Property Tax Exemption is for qualifying seniors and surviving spouses of seniors who previously qualified for the exemption. How to vote | The site Alabama Votes, run by the Alabama Secretary of State office, allows residents to check their voter registration status online. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. The following list of accepted forms of identification was current as of March 2023. A "no" vote opposedamending the Alabama Constitution to allow a qualified taxpayer age 65 or over to claim a senior property tax exemption on the taxpayer's principal place of residence when the home has been the person's principal residence for at least five years. Click Here . Religious or charitable ownership or non-profit use does not automatically exempt the property.. endstream

endobj

586 0 obj

<>/Metadata 48 0 R/Outlines 113 0 R/Pages 583 0 R/StructTreeRoot 124 0 R/Type/Catalog>>

endobj

587 0 obj

<>/Font<>/Pattern<>/ProcSet[/PDF/Text]>>/Rotate 0/StructParents 0/Type/Page>>

endobj

588 0 obj

<>stream

WebIf you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. A voter must provide a copy of his or her identification with both an application for an absentee ballot and the completed ballot itself, with the exception of 1) voters for whom polling locations are inaccessible due to age or disability, and 2) overseas military members.[8][9]. The money gathered from property taxes is used by the government to fund the services that benefit the community, such as: Property taxes in Alabama are usually calculated by a tax assessor who comes to your property to evaluate it. Last November, Jefferson County, Alabama voters approved a constitutional amendment granting homeowners age 65 and older an exemption to freeze the assessed value of their primary residence to its value in the preceding year. A simple majority was required for the approval of Local Amendment 1. Please contact your local taxing official to claim your homestead exemption. The ballot title for Local Amendment 1 was as follows: Relating to Jefferson County; proposing an amendment to the Constitution of Alabama of 1901, to authorize a qualified taxpayer age 65 or over to claim a senior property tax exemption under certain conditions on real property in the county used as the taxpayer's principal place of residence for not less than five years immediately prior to claiming the senior property tax exemption. 100 Jefferson County Parkway. If you qualify for the exemption, it does not reduce your tax rate, but instead reduces the taxable value of your property. Apply for the Property Tax Exemption in Alabama With DoNotPay Easily! 716 Richard Arrington Jr. Blvd N If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. Agricultural & Horticultural Exemptions Disability Exemption Homestead A citizen cannot have been barred from registering due to a felony conviction and cannot have been declared mentally incompetent by a court. The deadline to file your homestead is December 31. WebSpecial Senior Property Tax Exemption Q&A Is the Special Senior Exemption a full exemption for everyone 65 years of age or older? LinkedIn and 3rd parties use essential and non-essential cookies to provide, secure, analyze and improve our Services, and to show you relevant ads (including professional and job ads) on and off LinkedIn. State legislature | WebCounty property taxes may also be subject to the homestead exemption in Alabama. Book DMV appointments fast and easy, appeal your parking citations, sign up for free trials without disclosing your credit card info or phone number, or reach your loved ones in jailall in less than five minutes. Pay your Property Tax. The Alabama Property Tax Exemptions for Seniors. Webjefferson county, alabama property tax exemption for seniors. You must show proof of ownership of the property. If you are looking for simplified and user-friendly guides on how to lower your property tax rates. Suite 2500. Property owners in this bracket are still responsible for county school taxes. There are several different types of exemptions a home owner can claim in the State of Alabama. October 1: Taxes Due 619 0 obj

<>/Filter/FlateDecode/ID[<43DD81497C59B446850198F546AE181A><37866D2A39E9DE47BDCACAAA37BDE7C2>]/Index[585 70]/Info 584 0 R/Length 132/Prev 583923/Root 586 0 R/Size 655/Type/XRef/W[1 3 1]>>stream

Taxpayer is permanently and totally disabled exempt from all ad valorem taxes. State executives | Before sharing sensitive information, make sure youre on an official government site. h]o6 The Alabama Property Tax Exemption for DisabledRequirements, Disability status must be evidenced by at least two medical documents explaining the nature of the disability or a copy of the original letter of award from Social Security or the Veterans Administration, Documents must state the month and year that disability began, You must validate the documents annually by signature, Convenient Ways To Lower Your Property Taxes, If you decide to do any home improvement projects before the property tax assessment, it is possible that your tax will amount to much more than it would before any renovations, so make sure you avoid doing them, Errors on your property tax bill are common and easily made, so it is of utmost importance to double-check if your bill has any, The best way to reduce your property taxes is by letting DoNotPay generate a guide and identify every property tax exemption you could qualify for. Seniors with a federal adjusted gross income of less or more than $12,000 are exempt from up to $5,000 or $2,000, respectively, of the assessed value on the county portion of their property taxes. 1(eYq|f]~c 2J"e%91~DKgCs?ri.5`(l(E>M?zGLK}~tO!ro jpo0Rt i30l818F 8# k]9,dj~*Vq-kui{l5g/*bP_*PHG9V5xli~yqb1Eqy0hW >FD, :2[?ebz2q/3V&?,VHV+r/6 These homeowners may be exempt from some or all of their county or municipal property taxes as well if they qualify for a homestead or primary residence exemption. Everything About the Alabama Property Tax Exemption for Seniors. Alabama does not practice automatic voter registration. A voter can obtain a free identification card from the Alabama Secretary of State, a county registrar's office, or a mobile location. Jefferson County Special Senior Exemption Links (jccal.org), Special Property Tax Exemption for Jefferson County Homeowners Age 65 and Older - Deadline of April 30 to Claim, New Tennessee Brownfield Legislation May Open Opportunities, In Wake of DOJs Emphasis on Corporate Criminal Enforcement, Companies Should Listen Carefully to Whistleblower Complaints, The Second Circuit Weighs in on the Constitutionality of the CFPBs Funding Structure, Disagreeing with the Fifth Circuit, The Burr Broadcast March 2023 - The Fair Labor Standards Act and Executive Compensation.

A review of 100% of the property in a county will be completed over a four year equalization cycle. [1] According to state law, "[a]ll polling places in areas operating on eastern time shall open and close under this section pursuant to eastern time except the county commissions in Chambers County and Lee County may by resolution provide for any polling place to be excluded from this sentence and to be open according to central time. U.S. Congress | Public policy. 1 Click here to contact our editorial staff, and click here to report an error. Here are some of the most common ones and the eligibility details: An Alabama resident and a homeowner occupying your property as your principal place of residence, A citizen over the age of 65 meeting the income limitations set by the state of Alabama, A person with a disability who can prove their disability and meet the income requirements and limitations, A disabled veteran with a 100% disability rating who is disabled as a result of military service. It was approved. Taxpayer age 65 and older with income greater than $12,000 on their most recent Alabama Income Tax Returnexempt from all of the. Property tax bill with exemption. Webjefferson county, alabama property tax exemption for seniors. feature does almost all the work and is super easy to use! These cookies may only be disabled by changing your browser settings, but this may affect how the website functions. However, such things as re-roofing, minor repairs and painting, (normal maintenance type items), would not require a reassessment. The amount of a property's assessed value exempt from county property taxes under the homestead exemption depends on the owner's income. The senior exemption is even better in the Houston But even if you do 2"Ppf vC-]( if(document.getElementsByClassName("reference").length==0) if(document.getElementById('Footnotes')!==null) document.getElementById('Footnotes').parentNode.style.display = 'none'; What's on my ballot? How to vote | SegcsS9J{j ghe7ij3AyL'w#ZlLw.b{h/j dBNU9f As of publication, if a homeowner over 65 has an adjusted gross income of greater than $12,000 on his most recent state tax return, then up to $2,000 of his property's assessed value is exempt from county property taxes. As of publication, if a homeowner over 65 has an adjusted gross income of greater than $12,000 on his most recent state tax return, then up to $2,000 of his property's assessed value is exempt from county property taxes. U.S. President | The Jefferson County GIS tax map system is considered the leader in the state of Alabama. Housing Rehabilitation Specialist, http://birminghamlandbank.ORG/wp-content/uploads/2017/07/birmingham-logos2222-04-300x118.png, Senior Citizen or Disabled Property Tax Exemptions, February 2023 Regularly Scheduled Board Meeting. 0